MARMOMAC 2023:国际买家增长15%

Trending 2024-08-06

China’s iron ore and rolled steel prices surge to record high

Trending 2021-05-17

A new wave of supply shortages and price hikes in the semiconductor business is probably coming on the way.

Summary:

Lately in China, the prices of iron ore and rolled steel, significant ingredients in the steelmaking industry, keep climbing.

At the same time, another Covid lockdown is likely to arouse a new wave of supply shortages.

Futures of iron ore rose to 1,326 yuan per ton due to strong demand

A staff from Dalian Ore Port said the imports of iron ore reached more than 2 million tons last month, an increase of 20% compared to that in January and February. Most arrived cargo ships were loaded with more than 200 thousand tons of goods.

Meanwhile, given the fact that imports of iron ore were at a low level in the earlier months and that the shipments stays relatively high this year, the inventory level of iron ore at the port is slightly lower than that in the same period of former years. As of May 6, the inventory of iron ore from 45 Chinese ports added up to 1.296 billion tons, a decrease of 689.1 thousand tons from the previous period, according to statistic.

Jiansen Liu, an iron ore merchant from Zhejiang, China, said: We now have about 50 thousand tons of iron ore in stock, and the volume fell by a half from the same period in the last year. Most merchants are worried about high prices and thus dare not to keep their stock level too high. Previously, the prices of iron ore fluctuated by a few hundred yuan within one year, but now the change could happen within several days.

Some merchants informed that prices of PB Fines had grown to 1650 yuan per ton on May 10, marking an increase of 50 yuan per ton from May 9 and an increase of 550 yuan per ton from early April. Within one month, the prices have surged by 50%.

Due to multiple factors, the dominant iron ore contract has now increased to record 1,326 yuan per ton.

Beyond China, futures prices for iron ore in Singapore rose to more than $226 per ton, a record in dollar terms.

On May 7, The Platts 62% Fe iron ore index hit a record high at $212.75 per ton, 29% higher than the price of $164.50 per ton at the beginning of the year.

The Dalian Commodity Exchange warned market participants to control risks amid fluctuations in prices of coking coal, coke and iron ore, in a statement on its website.

Prices of steel scrap climbed to the peak as steelmaking prospers

Besides iron ore, steel scrap is an important ingredient for the steelmaking business as well. So how about its price changes?

The picture belowed shows us a steel scrap disposal plant in Haiguang Port, Shanghai. There are around 14 thousand tons of steel scraps in the plant, doubling the inventory volume in the same period of last year.

According to the staff, steel mills in Eastern China have raised the purchase price of steel scraps by over 300 yuan per ton.

It is reported that around 20 thousand tons of steel scraps should be disposed of every month. After being cut and compressed, the collected steel scraps would be sent to mills in the Yangtze River Delta Area for steelmaking.

Huaquan Zhang, the person in charge of a steel scrap disposal plant in Haiguang Port, said: As of today, my offer to the steel mill has reached 4000 yuan per ton. Compared to the price in early April, it has increased by at least 700 yuan per ton. The price had rised four times yesterday, with each time rising by 30 or 50 yuan.

Compared with the lowest point this year, the prices of steel scraps have been increased by over 50% and reached its peak, according to an insider.

After May Day, domestic inventories of building steels fell by 1.1 million tons in a year-on-year basis. In the case of short supply of rebar, steel mills are more profitable and thus substantially raise their purchase prices of steel scraps, as to compete for limited steel scrap resources.

Xionglin Jin, senior analyst of Mysteel Research Institute, commented: Generally, the price gap between rebar and steel scrap was about 1200 yuan per ton, but now it has widen to 2100 yuan per ton. As a result, the profits of a steelmaking factory using an electric arc furnace can reach over 800 yuan per ton. Nowadays, the rate of capacity utilization has grown to 76%, recording the highest level in the past few months. Therefore, steelmaking factories are very pleased to make use of steel scraps as ingredients.

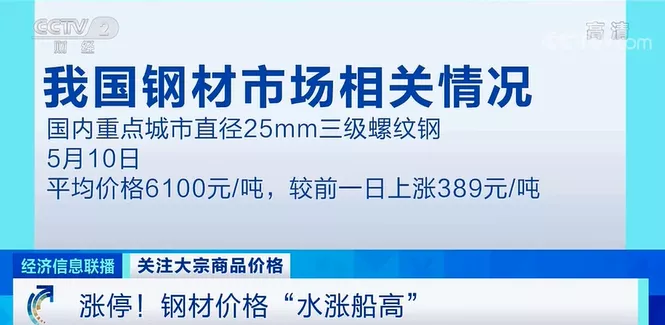

Rolled steel prices hit record high

Prices of ingredients keep growing, which also leads to the skyrocketing of rolled steel. On May 10, the spot price of rolled steel outperformed the highest level in the year 2008. Many dominant contracts in the futures market also closed with a limit-up surge in that morning. The dorminant SPHC steel contract in Shanghai Futures Exchange opened at a limit-up price.

Data reveals that on May 10, average price of HRB400 25mm in Chinese key cities went up by 389 yuan per ton to 6100 yuan per ton.

The price in May has surged by 1028 yuan per ton or 20.3% in a month-on-month basis. It surpassed the all-time high level of 5897 yuan per ton in 2008, setting a new record.

An insiders told us, although the recent data of the steel outputs and inventories indicates that the surging demand of steel seems to alleviate, the prices of steel remain strong thanks to the expected limits on steel production. The business profit is prone to return to its peak in the second quarter.

Malaysia declared lockdown from May 12

Malaysia has seen a spike in coronavirus infections in recent weeks, with country reporting 3,807 new cases on Monday. It has now seen a total of 444,484 cases and 1,700 deaths.

Prime Minister Muhyiddin Yassin said all inter-state and inter-district travel will be banned, along with social gatherings and educational institutions. The lockdown measures will start from May 12, and continue until June 7.

It’s widely acknowledged that Malaysia is an important manufacturing hub of semiconductor. There are over 50 semiconductor companies in Malaysia, most of which are multinational corporations such as AMD, NXP, ASE, Infineon, STMicroelectronics, Intel, Renesas, Texas Instruments and ASX. Among all those countries in Southeast Asia, Malaysia enjoys its unique strengths in the semiconductor assembly, packaging and testing market.

What’s more , Malaysia is also an important manufacturing center for resistor and capacitor companies from Japan and Taiwan, China.

In conclusion, Malaysia’s lockdown and the second outbreak of pandemic in India and some South Asian nations, will undoubtedly have an adverse impact on manufacturing capacity, especially in the field of semiconductor and MLCC.

Banning travellers from India could affect the E&E industries

As India is hard hit by the second wave of pandemic, Malaysia’s government has announced to ban entry of travellers from India. A report by ETTelecom indicates that Penang Island, a hub of electronic and electrical (E&E) manufacturing, will be substantially impacted by this announcement.

Penang State Executive Councillor for International Trade, Domestic Trade, Consumer Affairs and Entrepreneur Development, Datuk Abdul Halim Hussain pointed out there are about 3,000 professionals from India working in the state, mostly in software and IT. Those Indian professionals are needed to contribute to the E&E industries in order to meet increasing demands for electronic chips.

He added banning travellers from India, might hamper some professionals from India from coming here which could affect the E&E industries but admitted the impact was unavoidable. Datuk Abdul went on to emphasize that they will need to train local talents to reduce the reliance of imported talent to meet the state’s industrial demands.

Penang has established itself as a leading location in the world for microelectronics assembly, packaging and testing. It has a strong ecosystem supported by a network of over 3,000 well diversified local suppliers.

Given last year’s market performances during Malaysia’s first lockdown, a new wave of supply shortages and price hikes in the semiconductor business is probably coming on the way.

All the Posts/Comments showing on 77°Global Furniture Media only stand for individual perspective and should not be related to this platform`s standpoint! 77°Global Furniture Media is dedicated to being a vehicle which distributes global furniture news. Any content on 77°Global Furniture Media must not be reprinted unless it has been authorized, for more information, please contact the Email Address: news@77D.cn. For most of the posts which are not original, the permission has been granted. Please contact us if you have any problems related to copyright.